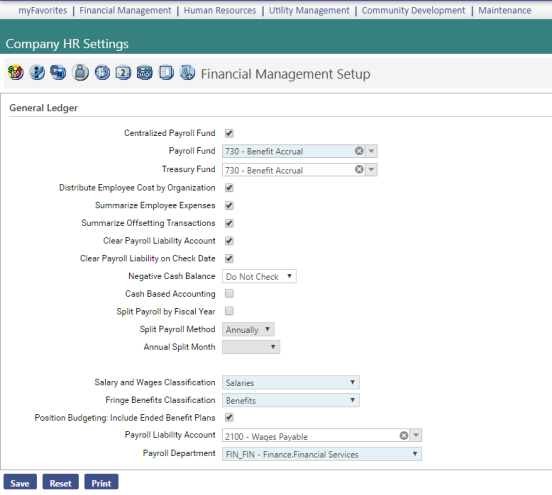

| Centralized Payroll Fund |

If each employee is paid from the cash account that corresponds to his fund distribution, do not check this box.

If payroll is paid from a central fund, check this box, and select the name of the fund in the Fund drop-down field located directly below this check box. This fund is used if due-to and due-from transactions are created from payroll.

|

| Payroll Fund |

Name of the fund from which payroll is paid. This entry is required if the Centralized Payroll Fund box is checked. |

| Treasury Fund |

To be used if your cash account is different from the payroll Paying Fund specified in Maintenance (Maintenance > new world ERP Suite > Chart of Accounts > Funds).

If your organization uses a Centralized Payroll Fund, this field is populated automatically with the Paying Fund from Maintenance but may be changed if the cash account is different from the Paying Fund. In either instance, an entry is required.

If your organization does not use a Centralized Paying Fund, this field is available but does not require an entry.

|

| Distribute Employee Cost by Organization |

Determines whether each employee is assigned a full G/L account (Fund-Dept-Account) or an organization set (Fund-Dept.)

If this box is checked, each employee is assigned an organization set only. When payroll is run, the account selected for the hours code, tax code, benefit code and workers' comp code is used to create a full G/L expense account.

If the box is unchecked, each employee is assigned a full G/L account, and the account information on the hours code is ignored.

|

| Summarize Employee Expenses |

Check this box to create a single entry for each general ledger account associated with employee expenses. |

| Summarize Offsetting Transactions |

Check this box to create a single entry for each general ledger account associated with employee expenses. |

| Clear Payroll Liability Account |

If checked, the payroll post creates an additional entry to debit the payroll liability account and credit cash.

Leaving this box unchecked eliminates an offsetting transaction on the journal entry.

If you post directly to cash rather than a liability account, do not check this box.

|

| Clear Payroll Liability on Check Date |

Enabled when the Clear Payroll Liability Account check box is selected, gives you the option to have payroll liability cleared on payroll check dates rather than on the payroll post dates.

|

| Negative Cash Balance |

Determines whether a warning or error message is generated if a payroll batch is associated with a payroll liability amount that exceeds the available cash G/L account balances.

The following three selections are available on the drop-down:

Do not Check: allows the payment register to be created without a warning or error message. This selection is the default.

Give a Warning: causes a warning message to be displayed during the Create Payment Register process, with the option to continue or cancel, if the payroll liability amount exceeds the available cash G/L account balances.

Do not Allow: causes an error message to be displayed during the Create Payment Register process if the payroll liability amount exceeds the available cash G/L account balances. An example of the warning is shown below:

The Net Payroll Cash Requirement Listing displays the balances of the source cash accounts and net expenditures.

|

| Cash Based Accounting |

Ensures that payroll disbursements do not hit expenses until they are paid. If this box is checked, the benefit expenses are debited and credited to net to zero ($0) for the expense account. When the disbursement invoice is posted in Accounts Payable, the expense is debited, and the liability account is credited. |

| Split Payroll by Fiscal Year |

If this flag is checked, posting a payroll creates two journal entries charging expenses based on the actual hours worked in each fiscal period; for example, the gross from any hours code entered in the current year is charged to the current year. Any hours code entered in the following fiscal year is charged to that fiscal year; therefore, if you have a salary amount or enter all hours in one fiscal year, all of the gross is charged to that fiscal year.

The fiscal year is determined based on the default fiscal start month in Company Suite Settings.

Note: If Split Payroll by Fiscal Year is selected, payroll validates according to the Split Payroll Method selected.

|

| Split Payroll Method |

Split Payroll Methods:

- Monthly: Payroll splits when the first day of the month falls between pay start and pay end dates.

- Quarterly: Payroll splits when January 1, April 1, July 1 and October 1 fall between pay start and pay end dates.

- Annually: The split month needs to be selected, and payroll splits when the first day of the selected month falls between pay start and pay end dates.

Note: After the installation of New World ERP, if Split Payroll by Fiscal Year is selected, the Split Payroll Method is blank, so a selection must be made before a payroll is validated.

Note: If Split Payroll by Fiscal Year is selected, payroll validates according to the Split Payroll Method selected.

|

| Annual Split Month |

Available selections: 12 months of the year. |

| G/L Distribution for Certified Positions |

Note: This field is available with separate licensing to the Contract Pay feature in Workforce Administration.

Separates FICA and Medicate general ledger distributions based on certified and non-certified employment.

Selecting this check box adds certified and non-certified debit distribution fields to the FICA Tax and Medicare Tax pages in Maintenance.

|

| Salary and Wages Classification |

Determines how wages are to be classified for financial reports. The choices in this drop-down come from the Expenses folder on the G/L Account Summary Codes page in Maintenance (Maintenance > new world ERP Suite > Chart of Accounts > G/L Account Summary Codes > Base Financial > Expenses). |

| Fringe Benefits Classification |

Determines how benefits are to be classified for financial reports. The choices in this drop-down come from the Expenses folder on the G/L Account Summary Codes page in Maintenance (Maintenance > new world ERP Suite > Chart of Accounts > G/L Account Summary Codes > Base Financial > Expenses).

This classification may be the same as the Salary and Wages Classification.

|

| Position Budgeting: Include Ended Benefit Plans |

Select to have Position Budgeting initialization process include employee benefit plans that end within a year of the budget start date, deselect to have the initialization process exclude employee benefit plans that end prior to the budget start date or begin after the budget end date.

Note: Position Budgeting lets you view and delete benefit plan elections from the Budget Position page.

|

| Payroll Liability Account |

Account to be credited for the net payroll amount.

If the Create Cash Offsetting Transactions box is checked, select a liability account; otherwise, select the cash account.

|

| Payroll Department |

"Functional" department responsible for running payroll. When the payroll is posted, the journal entry created comes from this department.

The user responsible for posting the journal entry in Finance needs the ability to approve journal entries for this department.

|